Share this post

Capacity constraints: Who's aiding the shipping crisis?

Global capacity constraints have been a growing issue for the logistics and shipping industries.

With the demand for freight services increasing, capacity is becoming increasingly difficult to find.

But are consumers aiding the capacity crisis?

First, let's explore the main capacity constraints and their impact.

What are the main capacity constraints?

Several factors can lead to capacity constraints, including:

- Extreme weather

- Lack of drivers

- Ships not operating at full capacity

- Changing regulations that limit trucking hours

The capacity crisis has had a significant impact on the global shipping industry.

In particular, capacity constraints have resulted in higher costs. As freight demand increases, the logistics infrastructure hasn't had time to adapt, leading to decreased capacity at ports and in last-mile distribution throughout the United States.

Additionally, transporting products cost-effectively and efficiently is becoming increasingly difficult for importers and logistics service providers (LSPs).

Why?

Because there is a shortage of drivers and logistics workers.

Capacity constraints and the consumer

Two things we can all agree that have changed since Covid-19 first appeared, buying and selling habits have changed.

For a time, it all came to a rapid halt. Then consumers turned to online purchasing for pretty much everything, forcing producers to set themselves up for such purchases.

What we see now, is a continued growth in the purchase of goods, especially those that need international shipment.

But is our increased thirst for purchasing crippling the supply chain?

Video 1: The shipping chaos explained

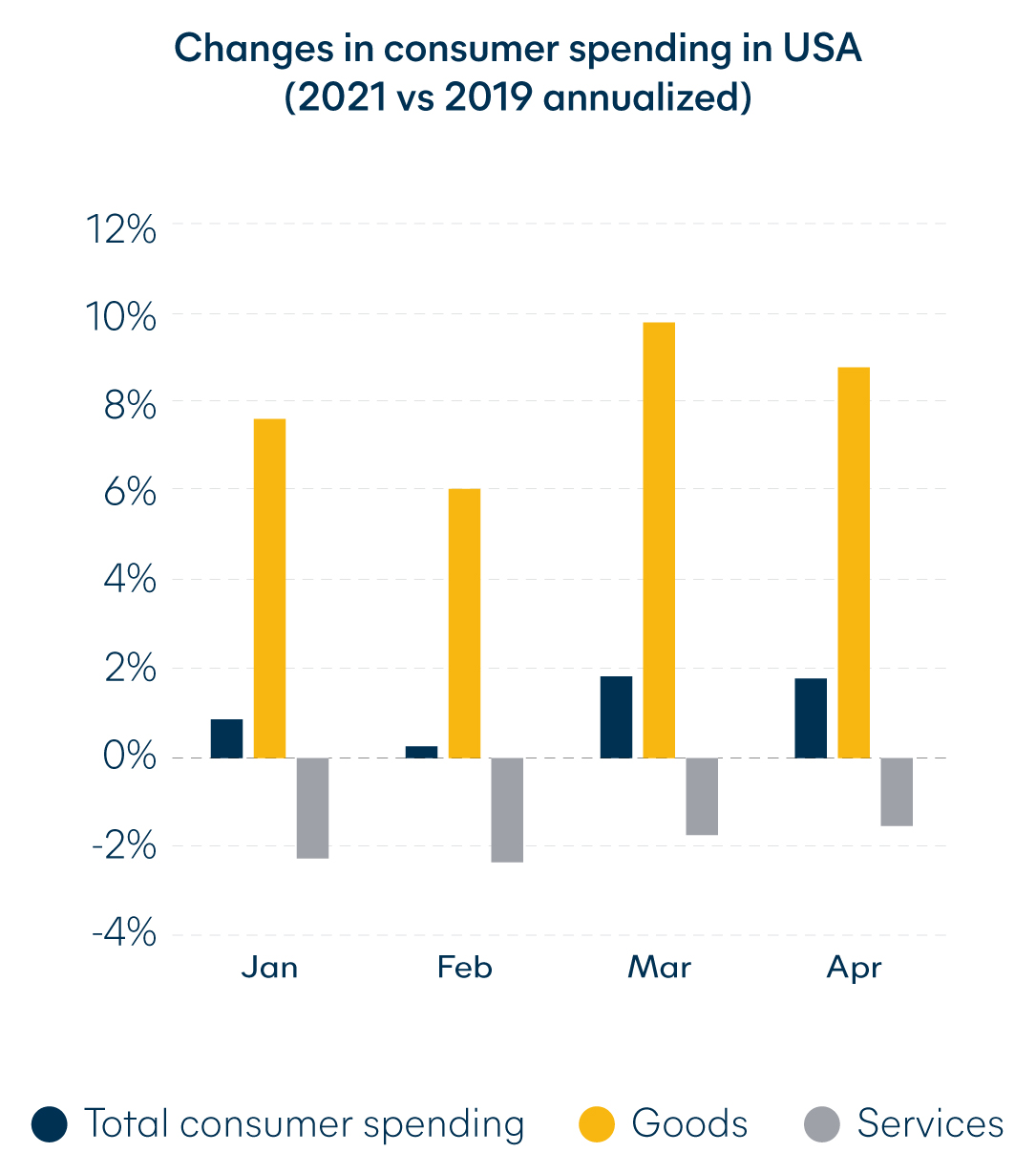

Take the US for example, they recorded over 20% growth in April 2021 (vs April 2020 or 6,8% vs April 2019) in consumer spend, that’s a huge upturn in sale. Great for clawing back a much depreciated cash pot thanks to the pandemic, but it also meant record low inventory and pressure on an already strained ocean container market.

So whilst the ability to ship with confidence remains unprecedentedly low, the demand for shipping containers to pack and ready cargo for whatever voyage you can get, reaches an all-time high.

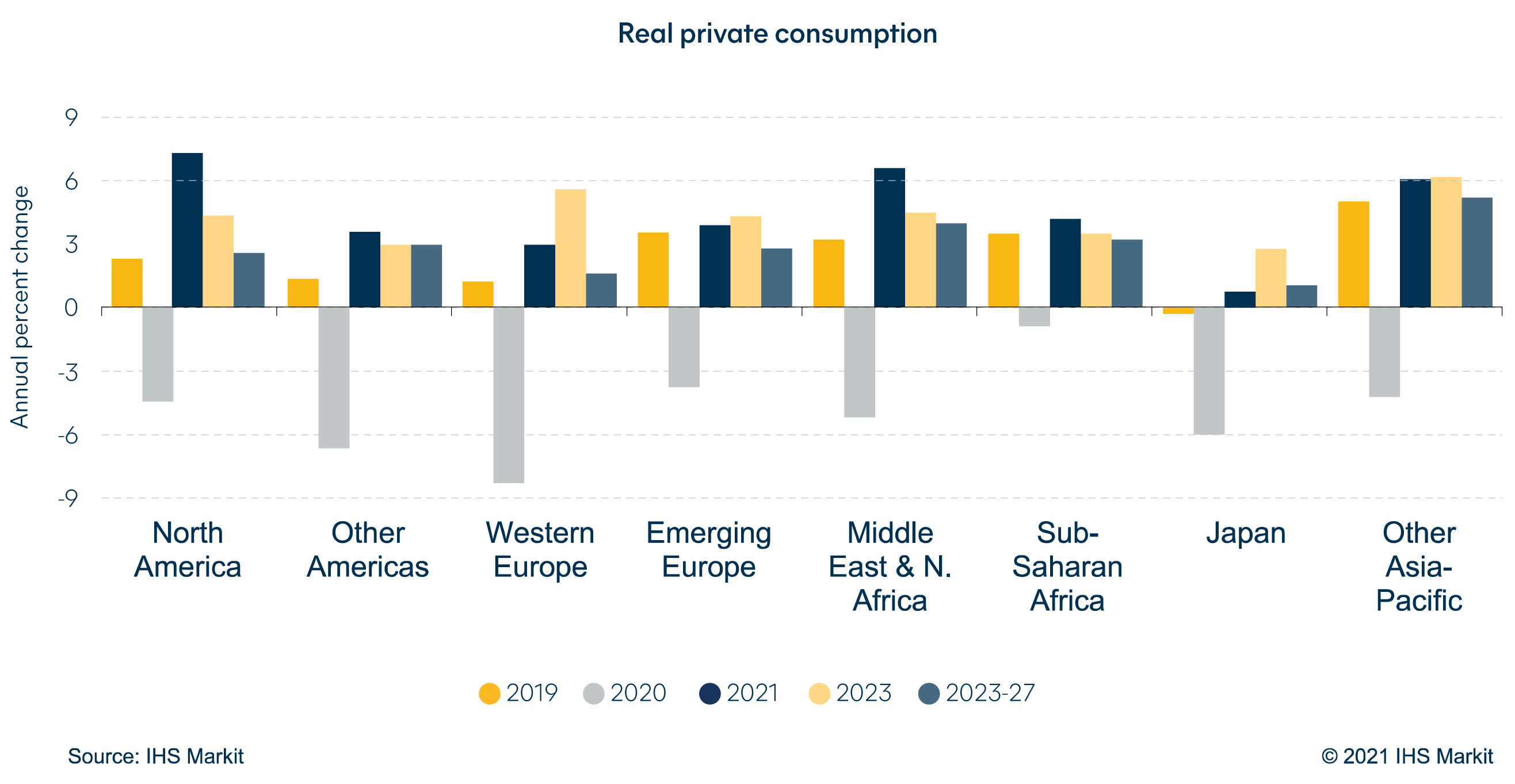

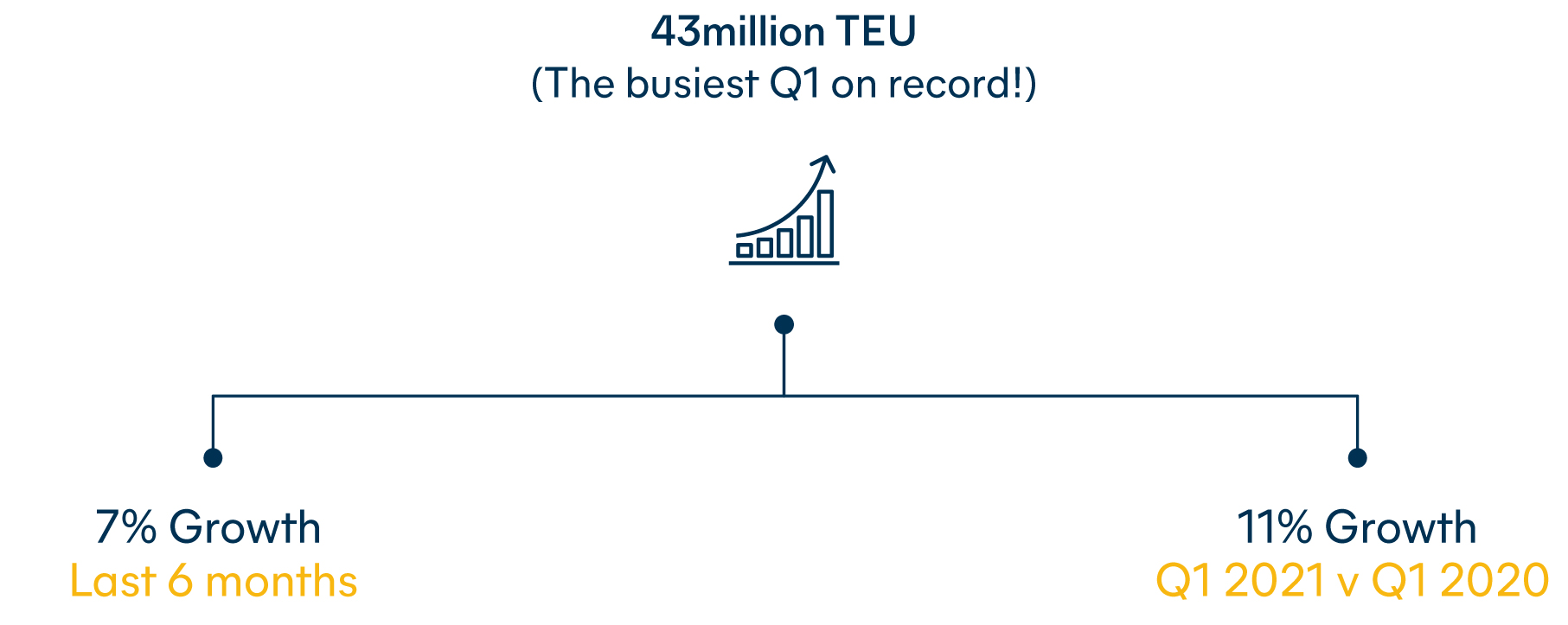

The largest share of that growth was concentrated to US demand. North American imports were up by 33.6% in the first four months of the 2021, reaching 10.9m TEU.

Moreover, almost 70% of total North American imports were products manufactured in Asia, which grew 45.0% from last year. I’m fondly referring to the US and Asia as the troublesome two now.

Both also struggling still with severely underperforming quayside operations, especially in Oakland and Yantian with a wait time for berth showing around 14 days. In April 2021, 39% of vessels were on time.

For carriers, it’s all a big global balancing act. Strong demand in one place, requires an injection of capacity and supply.

But, this comes at the cost of taking it from another place.

At the moment, demand is growing everywhere, and due to container imbalances mainly between the troublesome two, and container production playing catch up, we’ve all become well versed in the consequences:

- Port and intermodal congestion

- Port omission

- Vessel delays

- Capacity shortages

- Blank sailings

- High freight rates

It’s an old saying that ‘when it rains, it pours’, and I think we’re all feeling pretty drenched right now. Here’s a shocking fact for you, in April, 2.1 million TEUs (8.6% of nominal container fleet) were missing, or more accurately, they were tied up in vessel delays.

That’s literally the equivalent of removing from the seas the entire global fleet of container vessels able to carry over 18,000 TEUs. For further context, there were about 300 vessels waiting to berth in Yantian port.

15% to 20% of the global container fleet was ‘unavailable’

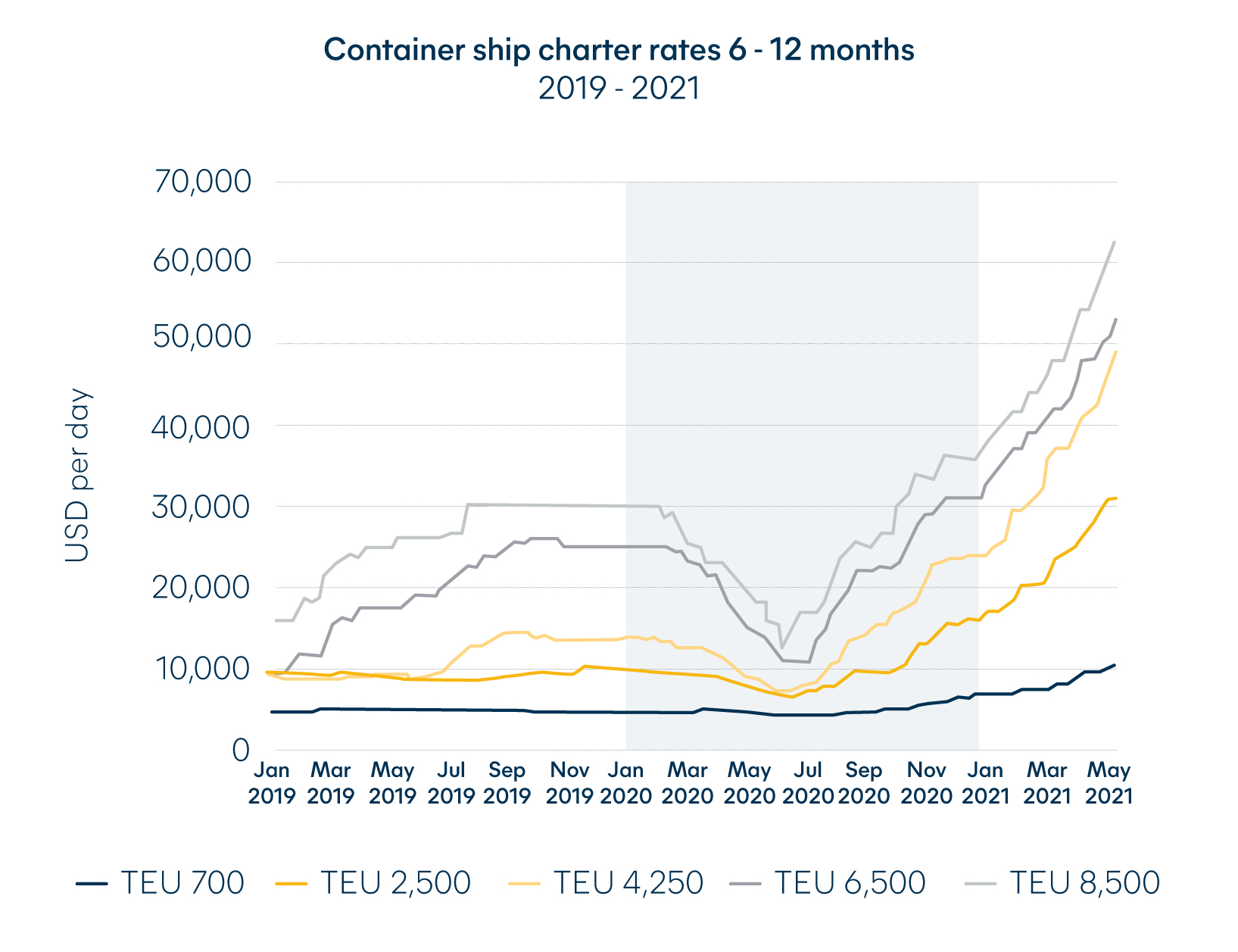

Until 2023, when new container vessels take to the seas, capacity growth is unlikely to meet demand. Costs are also unlikely to get better. To give you a flavor of operational charter costs in 2021, we saw a contract signed for few months at $148,000 per day!

It’s really wasn’t looking good for the peak season ahead although some good news came to light; Suez Canal Authority (SCA) and Ever Given’s vessel owner came to an agreement in principle over their pending compensation claim. Plus, Yantian port was reported to be back in full operational swing after clearing 21 consecutive days without new Covid-19 cases.

Video 2: Charting a course ahead

How to get ahead of capacity constraints

Our advice to our customers is to factor in more lead time to optimize the supply chain, hold inventory closer to sale where possible (ask us about our warehousing options), consider groupage services to move smaller quantities more frequently and air freight for speed and reliability.

Download more information

-ebook-1---global-freight-forwarding/hil---cta-text-1---ebook-global-freight-forwarding-(1).png?sfvrsn=a2292c3e_3)

-ebook-1---global-freight-forwarding/hil---cta-post---blue.jpg?sfvrsn=f6dabc2a_2)